Artificial intelligence is transforming the world faster than anyone anticipated. You see the headlines about breakthroughs in chatbots, image generation, and autonomous systems. But behind the excitement lies a brewing crisis that will hit financial markets and hardware supply chains hard over the next few years. Explosive demand for AI infrastructure is creating chip shortages, skyrocketing energy costs, and potential stock market volatility that investors cannot ignore.

This article breaks down the AI-driven disruptions to financial markets and hardware sectors. You will learn the specific shortages affecting chip prices, the energy crunch threatening data centers, and the investment bubbles that could burst by 2027. We draw from recent analyses by Reuters, Bloomberg, and industry experts to show what is happening and how to navigate it.

Hardware Shortages: The Memory and GPU Crunch Hitting Everyone

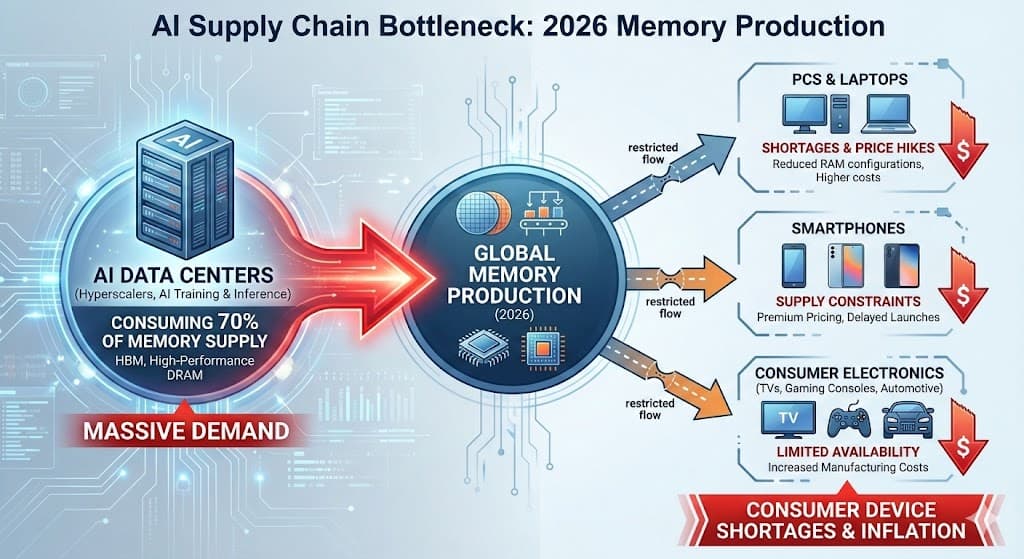

AI models require massive amounts of high-bandwidth memory (HBM) and powerful GPUs to train and run. Data centers now consume 70 percent of all memory chips produced in 2026, leaving consumer electronics starved for supply. Manufacturers like Samsung and SK Hynix report their AI memory sold out through 2026 and into 2027. Regular DRAM for PCs and smartphones faces 50 percent price hikes this quarter alone.

Smartphone shipments may drop 2.1 percent in 2026 as costs rise and production slows. PC markets could shrink 4.9 percent after last year's growth. Apple has warned suppliers that memory costs are squeezing profits, forcing product redesigns or price increases for consumers. NVIDIA's Blackwell GPUs are booked solid for 12 months, delaying AI projects and amplifying the shortage.

This crisis spreads beyond tech giants. Automakers and appliance makers compete for the same basic chips now diverted to servers. Lead times for servers stretch months, and prices for consumer RAM modules surge 10 to 15 percent post-CES announcements. The result is higher prices for your next laptop, phone, or even car electronics.

Energy Crisis: AI Data Centers Overwhelm Power Grids

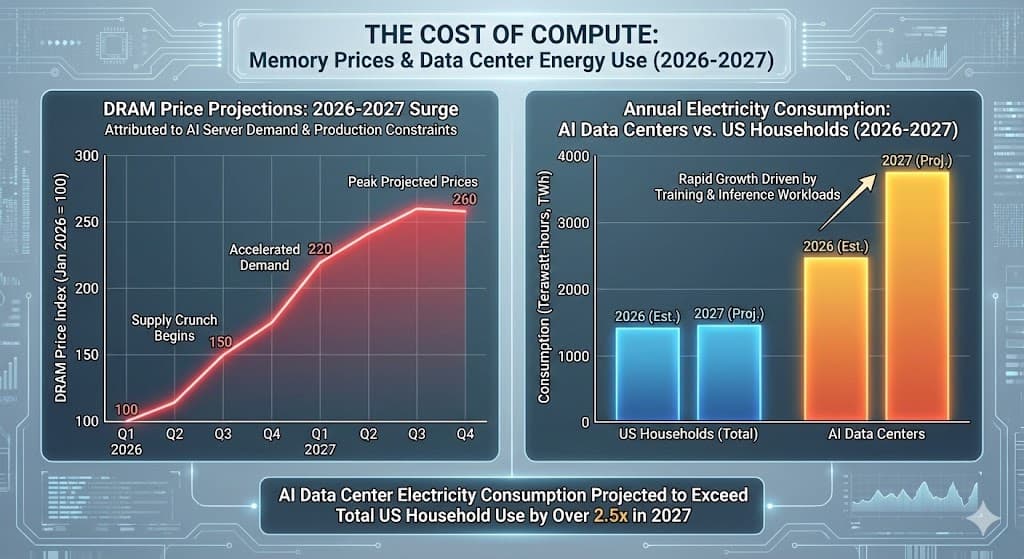

AI training consumes electricity at scales rivaling entire countries. By 2026, data centers could use 4 to 12 percent of US electricity, up from 1 to 2 percent today. Wholesale power prices near data centers have jumped 267 percent in five years, driving household bills higher.

America's largest grid, PJM Interconnection, struggles with demand from Virginia's Data Center Alley, which could hit 50 percent of regional power by 2026. New centers from NVIDIA, Microsoft, and OpenAI need gigawatts equivalent to powering millions of homes. Grid operators warn of blackouts without massive new capacity, but building plants takes years.

This power crunch fuels inflation. AI infrastructure demand boosts energy sectors but strains utilities. Central banks may pause rate cuts as inflation ticks up from electricity costs. Investors in renewables and grids see opportunity, but everyday consumers face 20 percent summer bill hikes in affected areas.

Financial Markets: Bubble Risks and Volatility Ahead

AI stocks drove S&P 500 gains of 17 percent in 2025, with seven tech firms claiming half of profits. But 2026 forecasts call for moderation. Analysts predict high-single to low-double digit returns, down from recent surges, as valuations face scrutiny. BlackRock expects AI dominance but with turbulence from leverage and crowding.

Warnings of an AI bubble grow louder. Capital Economics sees a 2026 burst from higher rates and inflation weighing on equities. If AI investments fail to deliver productivity gains, market corrections could hit tech hard. Hedge fund leverage near records amplifies selloff risks.

Yet some see upside. IMF forecasts steady 3.3 percent global growth from AI offsetting trade issues. Small-caps and value stocks may rally as rates fall, per Jefferies. Energy and infrastructure benefit from data center buildouts.

| Market Segment | 2026 Projection | Key Risk | Opportunity |

|---|---|---|---|

| AI Tech Stocks (NVIDIA, etc.) | Moderate gains, high volatility bloomberg+1 | Bubble burst if profits lag nytimes+1 | Continued capex if ROI materializes reuters |

| Memory/Chip Makers (Samsung, Micron) | Strong profits from shortages reuters+1 | Oversupply post-2027 reuters | Sold out through 2026 cnbc |

| Consumer Tech (Apple, PCs) | Declines in shipments/prices up reuters+1 | Shortage squeezes margins nytimes | Premium pricing power reuters |

| Energy/Utilities | Surging demand bloomberg | Grid strain, regulation reuters | Infrastructure boom reuters |

Common Misconceptions About the AI Crisis

Many think AI shortages are temporary like pandemic GPU crunches. Wrong. AI chips were under 0.2 percent of wafers in 2024 but generated 20 percent revenue, creating permanent bottlenecks. Others believe only enterprises feel pain. Reality hits consumers through higher device prices.

Investors assume endless AI stock gains. But if productivity disappoints, corrections loom without systemic crisis. Energy fixes won't come fast. New plants take years while demand doubles by 2026.

When NOT to panic-buy AI hardware now. Enterprises with stockpiles wait out peaks. Retail investors avoid over-leveraged tech bets during volatility spikes.

Navigating the Crisis: Strategies for Investors and Buyers

Diversify beyond pure AI plays into energy, infrastructure, and value stocks. Stockpile critical hardware if you run AI workloads. Delay non-essential consumer upgrades until 2028 when capacity catches up.

Watch inflation signals. Central banks may hike rates sooner if AI fuels persistent price pressures. Governments push grid investments, creating policy risks and opportunities.

The AI crisis reshapes markets profoundly. Demand drives growth but shortages create friction. Prepare for volatility. Position for the buildout phase.

FAQs

How severe is the AI-driven chip shortage expected to be in 2026?

Extremely severe and persistent. Data centers will consume 70 percent of global memory chip production, diverting HBM, DRAM, and NAND from consumer markets. Samsung, SK Hynix, and Micron report AI memory sold out through 2026-2027, with DRAM prices up 50 percent already and further hikes projected. NVIDIA's Blackwell GPUs have 12-month lead times. This curbs smartphone output by 2.1 percent and PC shipments by 4.9 percent, forcing Apple and others to raise prices or redesign products. The crunch echoes 2021 GPU shortages but lasts longer due to sustained AI capex.

Could the AI stock boom lead to a market bubble burst in 2026?

A significant risk exists, though not a full systemic crisis. AI stocks fueled 17 percent S&P 500 gains in 2025, with seven tech giants claiming half of profits amid sky-high valuations (e.g., NVIDIA P/E over 70). Analysts like Capital Economics predict a 2026 correction if AI productivity disappoints or rates stay high. Hedge fund leverage is at records, amplifying downside. BlackRock sees continued dominance but with volatility; IMF notes growth offset by trade risks. Diversify to value/energy plays for protection.

How is AI creating an energy crisis for power grids?

AI data centers could devour 4-12 percent of US electricity by 2026 (up from 1-2 percent), equivalent to powering 40 million homes. PJM grid faces 50 percent demand from Virginia alone, with power prices up 267 percent in five years. Building new capacity lags; blackouts loom without trillions in upgrades. This drives inflation (energy costs to consumers rise 20 percent in peaks) and may delay Fed rate cuts. Positively, it boosts utilities and renewables, but grids need years to catch up.

What practical steps should investors and buyers take now?

Investors: Shift to diversified plays in energy (utilities up 20-30 percent potential), infrastructure, and non-AI value stocks. Avoid leveraged tech bets; watch inflation for rate signals.

Buyers/Enterprises: Stockpile GPUs/memory immediately (prices peak now). Delay consumer upgrades to 2028. Enterprises prioritize efficient models to cut power use. Governments push supply chain diversification.